Binance Innovates, But Remains at Risk of Collapse like FTX

Navigating through a sea of challenges, Binance continues to forge its own path, championing the cause of crypto under the leadership of its indomitable CEO, Changpeng Zhao. Through its venture capital and incubation arm, Binance invests in crypto startups and drives technological advances, such as the Bitcoin Lightning Network, affirming its commitment to the industry.

However, the crypto giant is not immune to turbulence. A specter of uncertainty shadows Binance as it grapples with the United States Securities and Exchange Commission’s (SEC) allegations that echo those that crippled its once formidable competitor, the now-bankrupt FTX.

“Slowly, But We Keep Building,” Says Changpeng Zhao

Binance Labs represents the organization’s ongoing commitment to nurturing early-stage projects that are set to redefine the Web3 ecosystem.

In the latest iteration of its Incubation Program, Season 5, fewer than 2% of the over 900 applicants were selected. Bracket Lab, DappOS, Kryptoskatt, Mind Network, and zkPass emerged as the winners. This showcases Binance’s continuing efforts to foster innovation in the volatile world of digital finance.

“Binance Labs remains dedicated to empowering scalable early-stage projects that contribute to the advancement of the industry. We look forward to seeing the positive impact of Season five’s incubated projects on the broader Web3 ecosystem,” said Yibo Ling, CBO at Binance.

Simultaneously, Binance is working on integrating the Bitcoin Lightning Network to overcome congestion on the primary Bitcoin network.

This Layer 2 solution is designed to increase transaction throughput while reducing costs. Rivals such as Kraken and Bitfinex have already adopted the Lightning Network. Still, the integration by the world’s largest crypto exchange by trading volume will likely enhance the customer experience.

It will make deposits and withdrawals faster and cheaper. Thus, keeping Binance in line with market trends.

“Some eagle-eyed users spotted our new lightning nodes recently. Yes – that’s us! However, there is still more tech work to be done. We will update once Lightning is fully integrated,” said Binance.

While Binance invests in start-ups and implements technological enhancements, the SEC has filed charges that bear unsettling similarities to those against FTX.

The accusations range from offering unregistered securities to US residents to secret control of assets and operations. Moreover, misuse of banking relationships and intentionally bypassing restrictions for US-based traders put the company on shaky ground.

Binance’s SEC Lawsuit Resembles the One Faced by FTX

The allegations against the Binance CEO, Changpeng Zhao, cast significant doubt on the operational ethics of this firm. Like Sam Bankman-Fried, the former FTX CEO, Zhao faces charges of controlling trading firms and failing to maintain segregation between customer and corporate assets.

However, a crucial distinction exists between Binance and FTX. While Binance remains operational and continues to thrive, FTX has declared bankruptcy. Yet, as it innovates, it must also manage the regulatory challenges that contributed to the downfall of FTX.

The SEC lawsuits against Binance and FTX reveal striking similarities in the allegations against these crypto exchanges.

Key Similarities Between Binance and FTX:

Unregistered Securities: The SEC accuses Binance and FTX of offering unregistered securities to US residents. Binance allegedly failed to register its tokens — BNB and BUSD — and various interest-earning products. Likewise, the SEC alleges that FTX listed multiple crypto asset securities for US trading, including Solana (SOL), Algorand (ALGO), and Cardano (ADA), without its approval.

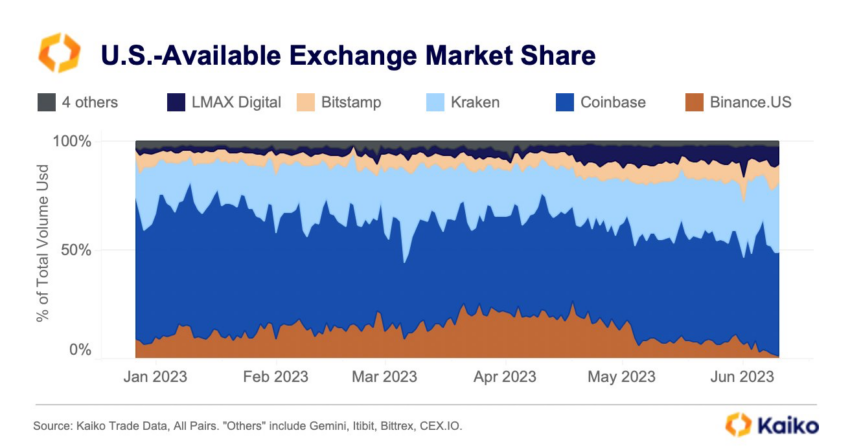

Secret Control of Assets: The SEC alleges that Binance.com and FTX.com secretly controlled some assets and operations of their US counterparts. Suggestions indicate that Binance wielded undisclosed control over Binance US and that FTX exercised similar control over the wallets used by FTX.US customers.

Misuse of Banking Relationships: According to the SEC, both crypto exchanges exploited the banking relationships of non-exchange entities controlled by their founders to facilitate fiat deposits. Binance allegedly instructed depositors to wire funds to Merit Peak, a hedge fund controlled by its founder, Changpeng Zhao. Likewise, FTX reportedly directed depositors to wire funds to Alameda Research, a hedge fund controlled by its founder, Sam Bankman-Fried.

Bypassing Restrictions for US-based Traders: The SEC alleges that both companies created US-specific entities (Binance US and FTX US) but covertly encouraged high-volume US traders to bypass these platforms and use the international exchanges with fewer regulations.

Trading Companies Controlled by Founders: Founders of both Binance and FTX allegedly controlled trading firms that operated on their respective platforms. Binance founder Changpeng Zhao reportedly controlled two trading firms — Merit Peak and Sigma Chain — that traded on Binance. FTX founder Sam Bankman-Fried controlled Alameda Research, a significant trader on FTX.com and FTX.US.

Commingling of Funds: Regulators say both companies blended customer assets with corporate funds, contradicting their commitments to segregate these assets.

Is Binance at Risk of Collapsing?

While the repercussions for FTX have been severe, the outcome for Binance remains uncertain. The question for the market and investors is whether Binance can navigate these regulatory challenges.

Despite the similarities between Binance and FTX, this underlines the need for transparency and regulatory compliance in the crypto industry. As Binance progresses with its incubation program and Lightning Network integration, it must address the SEC’s allegations.

The journey of Binance and FTX illustrates the dichotomy of rapid technological innovation and regulatory oversight. The case of Binance is an unfolding narrative that could set the tone for the crypto industry. Although the shadow of FTX’s demise looms large, it is too early to draw definitive parallels.

Only time will reveal if Binance will collapse. Especially if it is a tale of growth amid adversity or a cautionary story of operational risks overshadowing technological advances.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.